The Saskatchewan pulse trade relies largely on the presence of international markets to thrive. The profitability of the trade for pulse producers means that there has to be commercial exposure to external markets. The same applies to Canadian pulse traders.

Some two years back, lentils were top on the list of Saskatchewan exports pertaining to agricultural food exports, altogether topping the Canadian pulse exports for the year.

There is a raging global demand for Saskatchewan pulses. The largest importers of Canadian pulses cut across India, the United States, Bangladesh, China and a host of other nations. We will be addressing this subsequently as this post detailing the Canadian pulse industry continues.

Over the past few years, there has been recorded a tremendous amount of investments in the Saskatchewan pulse market. Complementing such significant investments have been increased crop production in these markets eventually increasing the volume of exports from the Saskatchewan market.

Canada economically sources a great deal from agriculture and pulses play a dominant role in this as well. Such exports cut across lentils, beans as far down to chickpea. In Canada alone, over 2 million hectares is deployed in pulse cultivation. This is well in proportion (that is not very surprising) considering the suitability of Canadian soil conditions that favor adept agricultural expeditions in Canada with the climate particularly supportive of pulse farming which can also be seen as a natural vest against insect and disease invasion; not forgetting the weather also condones long term grain storage. If you also consider the fact that pulse production in Canada has largely adopted the latest technologies, you can clearly see why a large scale pulse production has been a very practicable reality.

By 2014, production of pulse in Canada had spiked to over 6 million tonnes that by the next year, Canadian pulses (by their value) had touched $4.2 billion. However on an average, annual pulse production in Canada revolves around 4.5 million a year. On a general, the Canadian pulse industry is largely responsible for a majority of the weight of global pulse demands. Canada on its own supplies over 150 countries with pulses including chickpeas, beans, peas, in various sizes of shipment.

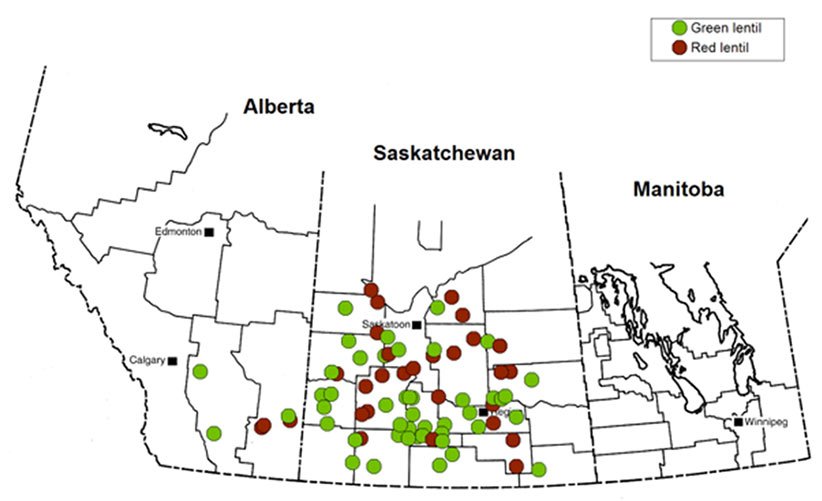

A lot of the peas come from Saskatchewan, while a lot of the bean exports come from Ontario (complemented also with beans from Quebec). When it comes to colored beans (as well as the white variety), it falls mainly to Manitoba and Alberta.

A lot of the peas come from Saskatchewan, while a lot of the bean exports come from Ontario (complemented also with beans from Quebec). When it comes to colored beans (as well as the white variety), it falls mainly to Manitoba and Alberta.

So now let us move into the quantification of Canada’s pulse exporters. As said earlier, India is the largest importer of Canadian pulse. India imports over 35% of Canadian’s total yearly pulse output.

Last year (that is in 2016), India voluptuously imported over 1.2 million tonnes of Canadian peas. This amounted to a trade exceeding $575 million. In addition to the peas import, Indian bought lentils amounting to about 493,070 tonnes from Canada. This worth another $460 million. Although changes in policies in India pulse import threatened to compromise as India promulgated changes to their quarantine program that greatly threatened the Canadian pulse export business.

Following India in the export chain is the United States. The United States comes second as it is well responsible for 10% of exports of Canadian pulse. The next nation on the list is China which comes at 10% importation of total Canada’s pulse export, and then to be succeeded by Turkey at 8%. Another major exporter is Bangladesh which shares export quantity with Turkey at 8% concurrently.

In general, Canada is the biggest producer and exporter of lentil in the whole planet. By 2010, Canada was amiably responsible for over 30 percent of the global production of peas. Earlier on in 2008, Canada had a larger share of the global pea producers market being responsible for over 54% of pea production in the world. By 2014, Canada accounted for over forty percent of the total lentils produced in the world for that year. The next year 2015, Canadian responsibility in the global lentil market has increased amounting to 76.8% of total production of lentils in the world.

So that is a general overview of the Canadian pulse import and export mechanism. By now you are convinced by Canada is the pulse powerhouse of North America.

Comments are closed.